Theranos: the fall of a paper billionaire and the value of transparency & collaboration in science

by Steven Lewis

As someone with type 1 diabetes, I prick my fingers several times a day to test my blood sugar. When I heard about Theranos and how it could completely revolutionize laboratory blood testing, I was beyond excited.

I was not alone. When Elizabeth Holmes founded Theranos in 2003, it seemed like she was “poised to change health care.”

“You’d have to look really hard not to see Steve Jobs in Elizabeth Holmes,” Kimberly Weisul reported for Inc.com in October 2015. Like the turtlenecked icon Jobs, Holmes dropped out of college and seemed destined to radically disrupt an industry before she was 40. Last year, she topped the FORBES list of America’s Richest Self-Made Women with a net worth of $4.5 billion.

But on June 1st, Forbes revised its estimate and announced Holmes’ net worth to be zero. Absolutely nothing. On June 12th, Walgreens ended its relationship with Theranos amidst allegations that the company’s technology did not work and that their tests had been run on the machines of competitors. Losing Walgreens was a “crippling blow for Theranos,” causing Theranos to close 40 of 45 Theranos Wellness Centers, a critical source of revenue for the company.

Despite my hope, I was not shocked. The company never published data showing how their technology performs comprehensive lab tests from “a few drops of blood.”

The FDA further complicated matters when they could not find sufficient evidence to approve any of Theranos’ allegedly functional tests (outside of one for Herpes, which was approved with several restrictions). The company is also under investigation by the Centers for Medicare and Medicaid Services (who seek to prohibit Holmes from owning or operating a blood testing laboratory for 2 years), the SEC, and the Justice Department for misleading investors and false marketing.

“Desperate to stop the shutdown of its California lab,” Theranos retracted tens of thousands of blood tests, two years worth of data.

HBO’s popular show “Silicon Valley” even took a shot at Theranos, when the main character responded to criticism of his tech startup by saying, “Our platform does exactly what it says it does. It’s not like we’re lying about it, like f*cking Theranos.”

Theranos’ downfall is a cautionary tale. The company’s exciting, well-marketed potential to “disrupt” health care was too irresistible for big corporations like Walmart to ignore. Many investors fell for the exciting, well-told story, despite the dearth of hard data.

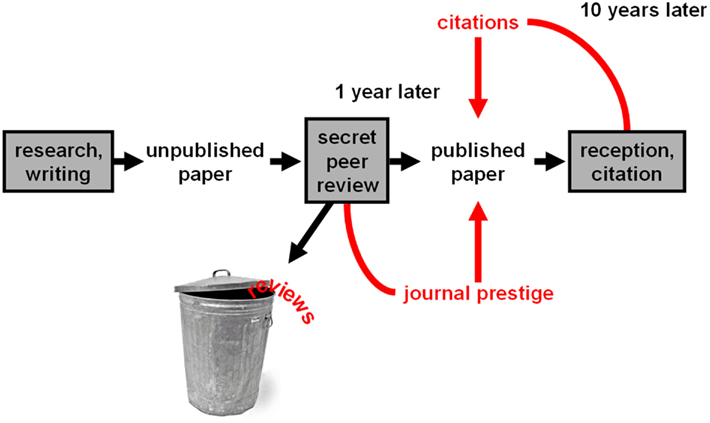

In the scientific community, biomedical research (often funded by the government bodies like the NIH) goes through rigorous peer review. First, journal editors must accept the researchers’ findings. Second, fellow scientists in the field conscientiously critique others’ research, sometimes leading to months of additional work before publication.

Peer review is best way we currently have to properly and efficiently contribute to the scientific enterprise and distribute knowledge. Publication allows for others to build on one’s discoveries, pushing the field forward. Peer review keeps the system honest and gives it a (relatively) unbiased stamp of approval by other scientists, who receive no compensation to review the papers they do evaluate. Rather, scientists participate in peer review “because they believe they are playing an active role in the community.” 84% of 40,000 randomly selected, published scientists who were surveyed about the practice of peer reviewing in academic science said they “believe that without peer review there would be no control in scientific communication.”

The hubris that one can revolutionize an entire field in secrecy for an extended period of time is dangerous and ultimately slows progress. In other fields, like the military or popular music, secrecy and surprise are assets. In science, objectivity and transparency are key.

Academic science is undoubtedly more dense, laborious and less “exciting” than new biotech startups with massive promises. However, an alternative pipeline in biotech is translating well-understood mechanisms from academic labs to the marketplace. This is accomplished by making connections through a University patent (“technology transfer”) office to a team in industry and finance equipped with the tools to form a company, make the product profitable, and sustainably produce it so that it ends up in the hands of those that need it in a responsible way. Theranos show us how taxpayer-driven NIH grants to academic laboratories need more support (and will in the long run be more beneficial for society) than venture capital funds poured into unproven biotech ideas.

Scientific progress, however slow, will always have value in its validity, objectivity, and emphasis on collaboration. Although exciting, pledges from flashy, “disruptive” companies need to be supported by real, peer-reviewed science. Moreover, we, as citizens need to be critical, skeptical, and cautious before supporting the next flashy biotech idea.

Steven Lewis is a rising junior at Yale majoring in molecular biology and history from Scarsdale, New York. This summer, Steven is a SURF student at Rockefeller studying pediatric brain diseases in the Gleeson lab and previously worked at Rockefeller while in high school as a part of the SSRP program studying immunology in the Krueger lab. Steven enjoys playing in the Yale Symphony Orchestra and has written about biotech, science, and medical research for the Yale Daily News.